Finance and investing is a must subject for all teens and adults to learn. Even into adulthood, we never stop learning from our own experiences or the experiences of others before us. Teens are in a wonderful position to start out life on the right foot as a young adult that will have a far reaching effect into their adulthood. By taking advantage of compound interest while they are young, it opens many doors for them throughout their life.

Whether you use all three resources or piece together, the skills taught in all three of these are invaluable. Even if your child is not college bound, taking note on how to fund different learning adventures and lifesikills will help them know how to go about things.

Three resources for teaching financial literacy

This post contains affiliate links, which means I receive a small commission, at no extra cost to you, if you make a purchase using links provided. Please see my disclosure page for more details.

Foundations in Personal Finance Series by Dave Ramsey: Education and dream jobs

Quite awhile back my husband and I attended a Dave Ramsey Financial workshop and really took some of his principles into the core of operating of our finances. Now that we have teens, we have used the concepts and principles in his workshop to set a ground foundation in the kids’ start of financial decisions. If you have not attended his workshops, I would highly recommend using the teen version series to get that basic foundation at the very out set of your teen’s financial journey.

His program will go over the principles in these areas as well as others:

- Budgeting and debt

- College: differences in higher educational institutions including trade schools, cost of living, military and on-the-job training

- How to pay for further education: 6 steps to get it debt-free

- Starting your own business or dream job steps

- Skills and personality for careers

- Networking and opportunity

- Interviewing, resume writing, job skills

Just a note: there are frequent sales and super sales for the series so it is very worth it to get on the e-newsletter to be alerted for large discounts off of the listed price. There is no reason to pay the full price.

Life of Fred Financial Choices: Planting your pizzas and starting a business

Life of Fred Financial Choices is a distinctly different approach and attitude. It follows Fred, a six year old genius professor, and his co-worker Helen as they navigate the difference between wants and needs in the world of consumerism. This book covers the ideas behind nterest, debt, happiness points, insurance, what is not a good investment, and many other basics.

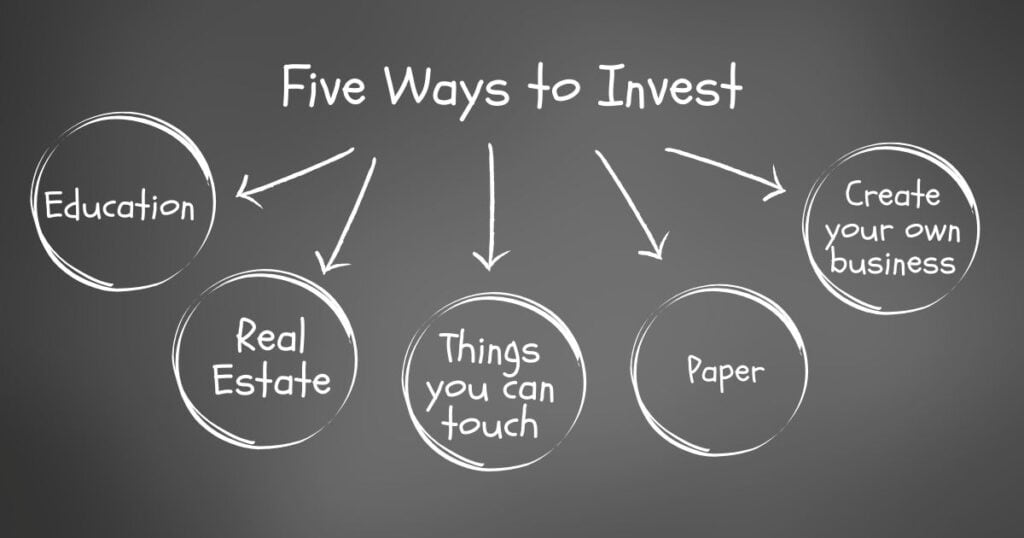

It spends a good share of time going over the five basic categories in which we can make our money work for us and which of those five would be a great place to start.

We enjoyed the focus on how to retire in 24 years by planting your pizzas and what specific percentage rate to aim for in investing to make that happen. It was a straightforward book with a unique way to convey the information on REIT’s, CD’s, mututal funds, insurance, etc. There was a strong emphasis on eventually creating your own business and some helpful tips on how to go about that.

While it doesn’t cover the mechanics of writing a check or making a budget, it was a worthwhile read to get an overarching goal of how money should be working for us and what are some non-helpful wastes of money.

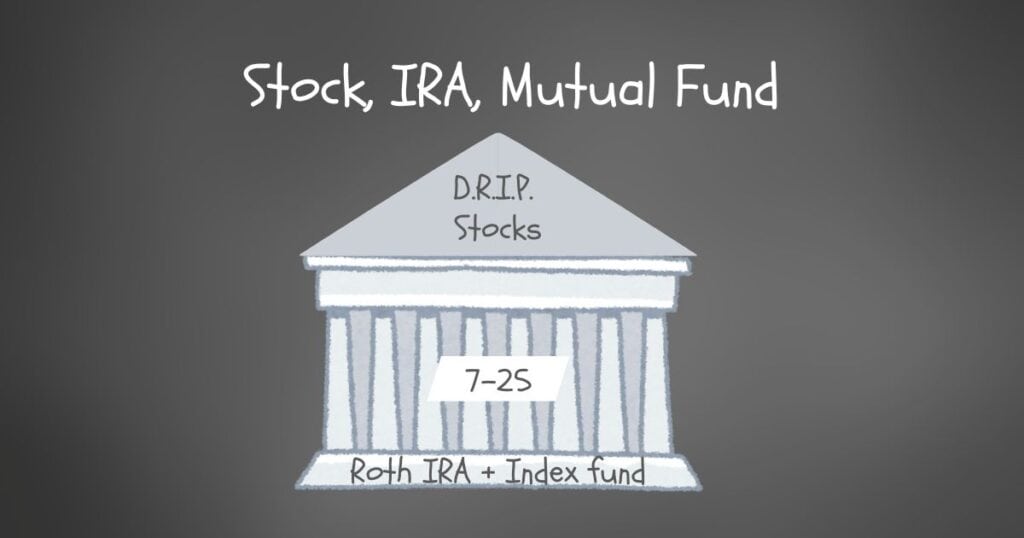

Motley Fool Investment Guide for Teens: Investing in stocks

This investment guide flows perfectly after reading Life of Fred Financial Choices as it zooms in and focuses on the key category of “Paper” which is highlighted in the “getting started planting your pizzas” concept in Life of Fred. Motley Fool has a treasure trove of a website that will also help with articles on recommended brokerages, stocks to watch, as well as an optional paid membership for specific stocks to watch, hold, sell, or buy. At the time of this writing If you sign up for their free e-newsletter, they will send the first five stock to consider as well as a deep discount of the first year of membership if you choose.

This little book is packed with helpful information for the beginning investor:

- Goals

- Budgeting

- Compounding interest

- College

- Credit cards

- Mututal Funds

- IRA’s

- Brokerages and fees

- Individual stocks

My husband and I used principles in Motley Fool’s other books and the paid membership when we were first married decades ago as a young couple combining our incomes. It set us up to be able to maneuver out of school loan debt and move forward in stocks successfully and confidently in the investment world.

There are many many options out there to teach your kids about finances. Don’t let them leave home without the knowledge and tools they need to go forward financially.

Jessica! That was awesome! You are such a wise treasure!

Thank you for the positive feedback. If anyone has a great tip to add, I would love to read it also;)